Travel advisories can void your insurance coverage if ignored. Learn how warnings affect claims and how to stay protected before your next trip. Stop for a second and envision this. Last year, I was all set for my dream trip to Bali—flights booked, itinerary planned, even a new suitcase I definitely did not need. Then, two weeks before departure, a volcano decided to wake up from its centuries-long nap. Flights got canceled, airports closed, and my travel insurance suddenly became the most important document in my life.

This is where travel advisories crash the party. Those government-issued warnings about safety, health risks, or natural disasters? They do not just affect your Instagram plans. They can make or break your travel insurance coverage in ways most people do not realize until it is too late.

Travel Advisories Are Not Just Suggestions

Here is something I learned the hard way: travel insurance is not a magic shield against all disasters. Most policies have fine print that says, “If you travel against a government advisory, we might not cover you.” I get it; insurers are not keen on paying for risky behavior. But what counts as “risky”?

When Canada issued a COVID-19 “avoid non-essential travel” advisory a while back, some travelers assumed their insurance would still cover them if they got sick abroad. Many policies treated it like a known risk, meaning claims were denied. The lesson? Advisories are not just bureaucratic noise. They are insurance loopholes waiting to happen.

How Advisories Mess With Your Coverage

Think about it. If your destination gets slapped with a “Level 4: Do Not Travel” warning after you book your trip, your insurer might still cover cancellations… but only if you act fast. Wait too long, and suddenly you are “accepting the risk,” which insurers love to use as an excuse to deny claims.

Then there is the gray area of “existing advisories.” Some countries always have warnings—pickpockets in Barcelona, hurricanes in the Caribbean. If you buy insurance after an advisory is already in place, good luck claiming losses related to that specific risk. I made this mistake once, assuming my policy would cover monsoon-related delays in Thailand. Spoiler: it did not.

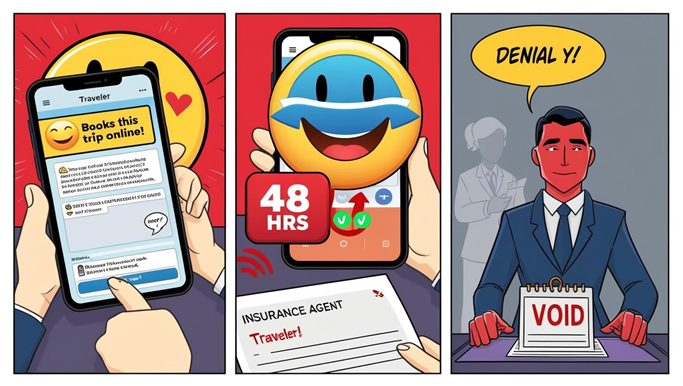

The Sneaky Thing About “Cancel For Any Reason” Policies

You might be thinking, “Fine, I will just get one of those fancy ‘cancel for any reason’ upgrades.” Smart move, except even those have limits. Many require you to cancel at least 48 hours before departure, and some still exclude destinations under active “Do Not Travel” advisories.

I learned this from a friend who booked a trip to a country that later had political unrest. Their “any reason” policy only reimbursed 75%, and only because they canceled before the advisory escalated. Had they waited, they would have gotten nothing.

What You Can Actually Do About It

First, read advisories before booking. The U.S. State Department’s travel site or your country’s equivalent is your best friend. If there is already a Level 3 (“Reconsider Travel”) or higher, assume your insurance will have exclusions.

Second, buy insurance early. Like, immediately after booking early. This way, if new advisories pop up later, you might still be covered for cancellations (depending on the policy).

Finally, ask questions. Most insurers have a 24-hour free-look period where you can review the policy and bail if the terms suck. Use that time to call and ask, “What exactly happens if a new advisory comes out after I buy this?”

The Bottom Line

Travel advisories are not just for paranoid diplomats, they directly impact whether your insurance will pay out when things go wrong. Ignoring them is like ignoring a “Bridge Out” sign and then being shocked when your car ends up in a river.

So yes, check those alerts. Yes, read the fine print. And no, do not assume your insurance has your back no matter what. Because if there is one thing I have learned, it is that volcanoes, governments, and insurance companies have one thing in common: they do not care about your vacation plans.

References

Murchland, J. (2024). How do the latest Level 4 travel advisories affect your insurance? Lonely Planet.

WorldTrips. (2024). What a travel advisory means for your international trip. WorldTrips Travel Insurance.

Hawk, A. (2018). Impact of travel insurance on the security of travelers [Project report]. Project List Nigeria.

Kuo, H.-W., & Chang, H.-C. (2023). Traveler’s knowledge, attitude, and practice about travel health insurance: A cross-sectional study. International Journal of Environmental Research and Public Health, 20(4), Article 9910690. https://doi.org/10.3390/ijerph200409690

https://pmc.ncbi.nlm.nih.gov/articles/PMC9910690/