Cyber threats are reshaping business insurance needs. Unlock the ways on how cyber liability impacts coverage, premiums, and risk management strategies in today’s digital landscape. I still remember the panic in the restaurant owner’s voice when she called me after a hacker locked her out of every digital system the Friday before Mother’s Day weekend, her busiest time of year. “Our insurance agent never mentioned cyber coverage,” she admitted as the ransomware demand flashed on her POS terminals. Her $85,000 loss became my wake-up call about how deeply cyber liability has infiltrated every business’s risk profile, regardless of industry or size.

The Silent Shift in Business Risk

Gone are the days when general liability policies adequately protected businesses. A decade ago, cyber insurance was a niche product for tech companies. Today, I’ve seen claims from bakeries whose customer databases were stolen through their online ordering system, HVAC contractors whose bank accounts were drained after a phishing attack, and even landscaping companies sued when employee social security numbers leaked from their payroll software.

The numbers tell a sobering story. Last year, the average ransomware payment reached $1.5 million, while business email compromise scams cost companies $2.7 billion according to FBI data. What shocks me most isn’t the scale of attacks, but how many businesses remain dangerously underinsured. A recent survey revealed 60% of small businesses lack standalone cyber coverage, often believing their general policies cover digital risks, a misconception that’s bankrupted more than one client after an incident.

How Insurers Are Responding

The insurance industry’s approach to cyber risk feels like it’s evolving daily. Early policies were notoriously broad, but after suffering massive losses, carriers have become hyper-specific about coverage terms. I recently reviewed two policies where the difference between “computer fraud” and “funds transfer fraud” wording determined whether a $200,000 loss would be covered.

Premium increases tell their own story. One manufacturing client saw their cyber premium jump 300% after a competitor in their industry suffered a breach, despite having no claims history themselves. Insurers now evaluate risk factors most business owners wouldn’t consider like whether employees use multi-factor authentication or if the company stores data in decentralized systems.

Perhaps most significantly, insurers have moved from passive risk transfer to active risk management. Many now require policyholders to implement specific security measures like endpoint detection software or employee training programs. I’ve watched carriers deny claims because a business didn’t install a mandated security patch within the required timeframe.

The Hidden Coverage Gaps

Many business owners learn too late what their policies don’t cover. Standard cyber policies often exclude:

Social engineering attacks where employees willingly transfer funds to criminals

Physical damage from cyber incidents (like fried servers during an electrical grid hack)

Reputational harm and customer attrition post-breach

Regulatory fines in certain industries

A client in the healthcare sector nearly faced ruin when their policy covered breach notification costs but not HIPAA fines, a $1.2 million oversight. Now I always recommend pairing cyber coverage with specialized professional liability policies for regulated industries.

Building a Resilient Strategy

After helping dozens of businesses navigate cyber claims, I’ve developed a three-pronged approach: prevention, protection, and response. Strong security practices can lower premiums by 20-30%, with insurers offering discounts for measures like encrypted backups and third-party security audits.

But the most valuable lesson? Documentation is everything. I advise clients to maintain detailed records of their security protocols, employee training sessions, and system updates. When a retail client suffered a breach, their meticulous logs proving regular software updates helped avoid a coverage denial that would have cost them $750,000.

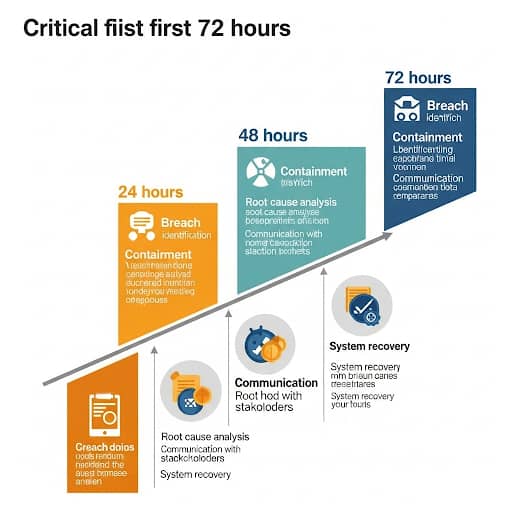

Response planning is equally critical. The businesses that weather cyber incidents best are those with pre-vetted forensic firms and PR teams in their insurance network. One prepared client had their systems restored and public statement issued within 72 hours of discovering a breach, their stock price barely budged.

The Future of Cyber Risk Transfer

Emerging solutions are changing the game. Some insurers now offer “captive” cyber policies for industry groups, while others provide proactive monitoring services that alert businesses to vulnerabilities before hackers exploit them. The most innovative policy I’ve seen includes bitcoin reserves specifically for ransomware payments, with negotiated rates through the insurer’s incident response team.

Yet for all the industry evolution, one truth remains: cyber risk can’t be entirely outsourced to insurers. The businesses thriving in this new era treat cybersecurity as cultural practice rather than compliance checkbox. They’re the ones training receptionists to recognize phishing attempts as diligently as they train sales teams to close deals.

As I remind every client: in our interconnected world, cyber liability isn’t about whether you’re tech-savvy, it’s about whether you’re prepared for the inevitable attempt. The right insurance coverage isn’t your first line of defense, but it might be the safety net that keeps your business alive after an attack. That restaurant owner? She rebuilt smarter with layered cybersecurity, employee training, and a policy that actually matches her risks. Her only regret was learning these lessons the hard way.

References

Federal Trade Commission. (n.d.). Cyber insurance. https://www.ftc.gov/business-guidance/small-businesses/cybersecurity/cyber-insurance

Ogunyemi, A. A. (2024). Cyber risks and the Nigerian business sector: A critical analysis of the emerging cyber insurance market in Nigeria. ACU Journal of Social Sciences, 3(1). https://ajss.acu.edu.ng/index.php/ajss/article/view/145

Erkan-Barlow, A., & Wells-Dietel, B. P. (2023). The current state of cyber insurance and regulation in the context of investment efficiency and moral hazard: A literature review. Journal of Insurance Regulation, 1. https://content.naic.org/sites/default/files/cipr-jir-2023-4.pdf

UK Government. (2017). UK cyber security report: The role of insurance in managing and mitigating the risk [PDF]. https://assets.publishing.service.gov.uk/media/5a80f0c5ed915d74e62314f7/UK_Cyber_Security_Report_Final.pdf