Surety and fidelity bonds protect businesses from financial losses, but how do they really work? Discover their critical role in risk management and why your business might need them. The first time a client asked me for a $500,000 performance bond, I panicked. As a new contractor, I didn’t understand why my general liability insurance wasn’t enough or what would happen if I couldn’t secure the bond. That moment sent me down a rabbit hole of discovery about these often-overlooked protections that quietly safeguard billions in business transactions every day.

The Difference Between Insurance and Bonds

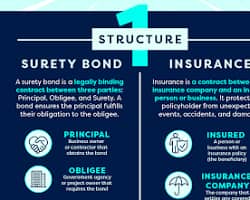

Most business owners assume their insurance policies have them fully covered, but bonds serve a fundamentally different purpose. While insurance protects against unforeseen accidents, bonds guarantee performance and honesty. I learned this the hard way when a competitor went bankrupt mid-project their clients recovered nothing, while my bonded jobs had financial backing to ensure completion.

Surety bonds act as three-party agreements where the bonding company (surety) guarantees to the project owner (obligee) that the business (principal) will fulfill its contractual duties. Fidelity bonds, meanwhile, protect against employee theft or fraud. When my bookkeeper embezzled $28,000, my crime insurance had a $50,000 deductible but the fidelity bond covered the full loss immediately.

When Your Business Can’t Operate Without Them

Certain industries practically require bonds to exist. Construction contractors need bid bonds to compete for public projects. Auto dealers must have license bonds to operate legally. Even janitorial services often need bonds to secure commercial contracts. I’ve seen talented small businesses lose game-changing opportunities because they didn’t understand bonding requirements until it was too late.

The underwriting process surprised me, it’s more like a loan application than insurance. Sureties examine credit scores, financial statements, and industry experience. My first bond application was denied due to thin operating history, forcing me to partner with an established contractor until I built sufficient credentials. Now I advise clients to plan for bonding requirements at least six months before needing them.

The Hidden Costs of Being Unbonded

Beyond lost opportunities, operating without required bonds can trigger severe consequences. A client in the freight brokerage space nearly lost his operating authority for lapsing on his $75,000 BMC-84 bond. Another faced liquidated damages when he couldn’t secure a payment bond for a public works project already underway.

Even when not legally mandated, bonds create competitive advantages. My bonded cleaning company landed a corporate campus contract because the risk manager valued the financial guarantee. The annual bond premium became my most effective marketing expense costing less than a trade show but opening far more doors.

Bonds might seem like bureaucratic red tape, but they’re actually powerful risk management tools. Whether protecting against contractor defaults or employee theft, these instruments provide something insurance alone cannot, financial guarantees of performance and integrity. The businesses that thrive are those that don’t just meet bonding requirements, but strategically leverage them as proof of reliability in an uncertain marketplace.

References

U.S. Small Business Administration. (n.d.). Surety bonds. https://www.sba.gov/funding-programs/surety-bonds

Bureau of the Fiscal Service. (2024, September 13). Background. U.S. Department of the Treasury. https://fiscal.treasury.gov/surety-bonds/background.html

Ernst & Young. (2022). The economic value of surety bonds. Surety and Fidelity Association of America. https://surety.org/wp-content/uploads/2022/11/surety_protects_2022_report.pdf

International Journal of Research and Innovation in Social Science. (2020). Surety bond acceptation: Summary quick underwriter method. 4(7), 464–468. https://scholar.ui.ac.id/en/publications/surety-bond-acceptation-summary-quick-underwriter-method