Losing your job doesn’t mean losing health coverage. Explore affordable insurance solutions for unemployed individuals and families. Mark never expected his corporate restructuring notice to include another devastating line: “Your health benefits will terminate in 14 days.” As a father managing his son’s asthma treatments, this loss felt more frightening than the unemployment itself. Like millions of Americans, he suddenly faced an impossible choice—risk financial ruin from medical bills or pay staggering premiums he could no longer afford.

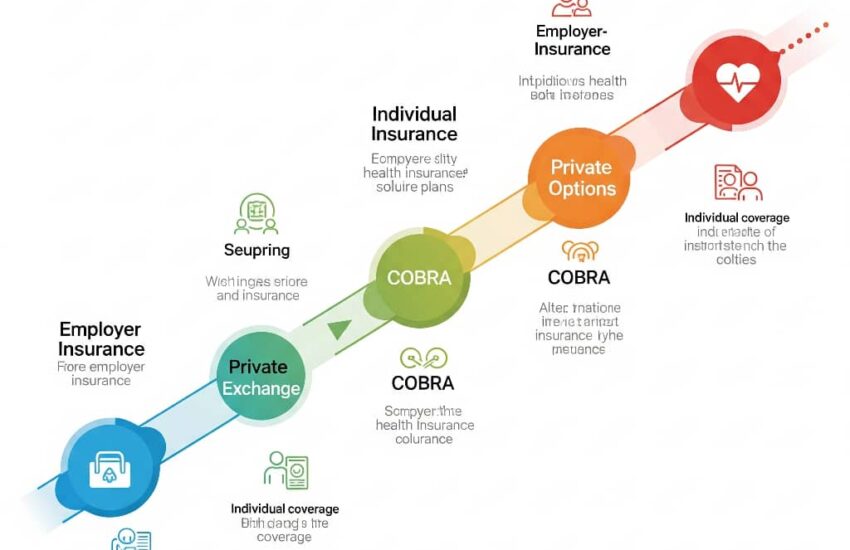

Job loss creates a healthcare crisis for many, but options exist beyond expensive COBRA plans or gambling without coverage. Understanding these alternatives can provide both medical protection and peace of mind during career transitions.

Immediate Coverage Solutions

The Consolidated Omnibus Budget Reconciliation Act, commonly called COBRA, allows continuing employer-sponsored insurance for 18 to 36 months after job loss. While this maintains existing coverage, the full premium cost often shocks former employees—averaging $700 monthly for individuals and $2,000 for families.

Marketplace plans under the Affordable Care Act offer more budget-friendly alternatives, especially with unemployment income reductions. Losing job-based health insurance qualifies you for a Special Enrollment Period, allowing plan selection outside standard annual windows. Premium tax credits based on projected income can dramatically lower costs—a family of four earning $40,000 might pay under $100 monthly for comprehensive coverage.

Short-term health plans provide stopgap solutions with limited benefits, typically covering three months to a year. These exclude pre-existing conditions but prevent financial catastrophe from unexpected emergencies. Medicaid expansion in 38 states covers low-income adults without dependent children, while Children’s Health Insurance Programs protect minors regardless of parental employment status.

Strategic Approaches to Affordable Care

Timing matters when transitioning between coverage options. COBRA permits retroactive enrollment within 60 days of benefit loss, a valuable option if medical needs arise during that window. Marketplace plans take effect the first day of the following month after enrollment, making prompt application crucial.

Community health centers provide sliding-scale primary care nationwide, with costs based solely on income. Many hospitals offer charity care programs forgiving portions of bills for unemployed patients. Prescription assistance programs through pharmaceutical companies supply medications at reduced costs or free for qualifying individuals.

Long-Term Considerations

Gig economy work, even as temporary self-employment, may qualify for small business health plans with better rates than individual policies. Professional associations sometimes offer group insurance to members in career transition. Those over 55 but under Medicare eligibility might explore healthcare sharing ministries as faith-based alternatives to traditional insurance.

Losing employer-sponsored health insurance creates undeniable challenges, but it doesn’t leave you unprotected. By understanding the array of available programs and acting within designated enrollment periods, you can secure appropriate coverage without draining limited resources. Remember, investing time in healthcare decisions today prevents far greater costs tomorrow, ensuring your focus remains where it belongs: on building your next career chapter with confidence and security.

References

Healthcare.gov. (2025). *Health care coverage options for unemployed*. https://www.healthcare.gov/unemployed/

Anthem. (n.d.). *Health insurance for the unemployed*. https://www.anthem.com/individual-and-family/insurance-basics/health-insurance/health-insurance-unemployed

Wellpoint. (n.d.). *Health insurance options for the unemployed*. https://www.wellpoint.com/individual-family/learn/health-insurance-unemployed

MoneyGeek. (2025, January 9). *Best health insurance options when unemployed (2025)*. https://www.moneygeek.com/insurance/health/best-health-insurance-unemployed/