Flexible Spending Accounts can save you thousands on healthcare costs, if you know how to use them right. Uncover how to maximize these tax-advantaged accounts without losing money. When Jane’s dentist told her she needed $2,300 worth of dental work, she almost postponed treatment until she remembered the $2,500 sitting in her Flexible Spending Account (FSA). By using these pre-tax dollars, she effectively got a 30% discount thanks to tax savings. Yet millions of Americans with access to FSAs leave money on the table every year, forfeiting an average of $500 per account.

FSAs represent one of the most powerful yet most misunderstood tools in health insurance policies. These employer-sponsored accounts let you set aside pre-tax money for medical expenses, but they come with unique rules that trip up many participants. Here’s how to make them work for you.

How FSAs Create Instant Savings

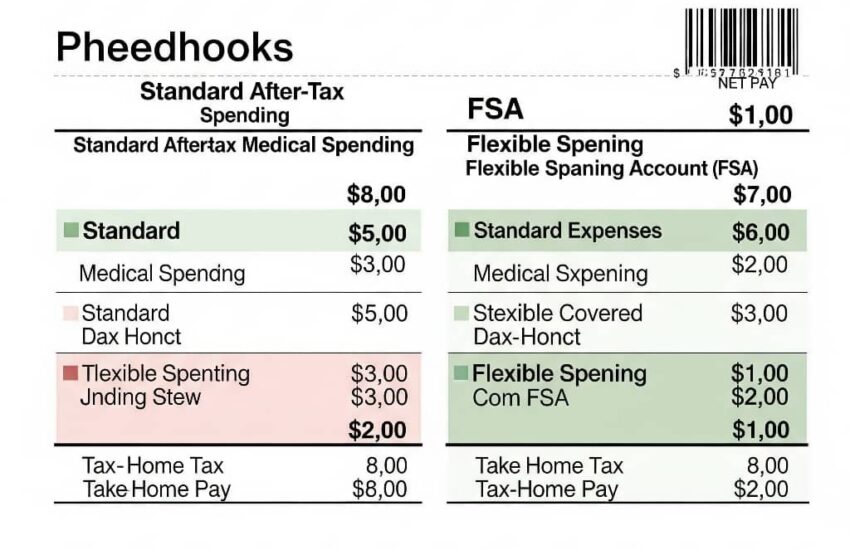

The magic of FSAs lies in their tax treatment. Every dollar you contribute avoids federal income tax, Social Security tax, and usually state income tax. For someone in the 24% tax bracket, this means $1,000 in medical costs really only “costs” about $700 from their paycheck.

The savings add up fast. A family contributing the maximum $3,050 (2023 limit) could save about $1,100 annually in taxes. These accounts cover everything from doctor’s copays to prescription sunglasses to fertility treatments. One policyholder even used his FSA to pay for his service dog’s veterinary care—an eligible expense many don’t realize qualifies.

The Use-It-Or-Lose-It Myth And Reality

The biggest FSA fear forfeiting unused funds stems from outdated information. While accounts previously required spending all funds within the plan year, most employers now offer one of two safety nets:

A 2.5-month grace period to spend remaining funds

Or a $610 rollover into the next year (2023 limit)

Still, careful planning matters. One account holder lost $400 because she didn’t realize her plan used the grace period option rather than rollovers. The key is knowing your employer’s specific rules and timing elective procedures accordingly.

Strategic Contribution Planning

Determining how much to contribute requires balancing optimism with realism. Consider:

Upcoming predictable expenses (eyeglasses, orthodontics)

Known recurring costs (prescription refills, therapy copays)

Potential unexpected needs (urgent care visits)

A young couple expecting a baby might max out contributions to cover delivery costs, while someone planning LASIK could align contributions with their surgery date. The smartest users maintain a running list of eligible expenses—many are surprised to learn things like sunscreen (with a doctor’s note), breastfeeding supplies, and even acupuncture qualify.

The Reimbursement Game

Modern FSAs offer debit cards, but paper trails still matter. Always save:

Itemized receipts showing service dates

Proof of payment (even for debit card transactions)

Letters of Medical Necessity for ambiguous items

One policyholder had to repay $900 when her FSA requested documentation for two-year-old chiropractic visits. Others successfully argued for unusual expenses like water filtration systems for medical conditions by submitting detailed doctor’s notes.

FSAs Versus HSAs: Knowing the Difference

While similar, Health Savings Accounts (HSAs) have distinct advantages and restrictions: FSAs are use-it-or-lose-it (with modest rollovers); HSAs funds roll over indefinitely, HSAs require a high-deductible health plan; FSAs don’t, HSAs can invest funds; FSAs can’t, and HSAs stay with you if you change jobs; FSAs don’t

The choice isn’t always either/or, some people use both strategically. One family contributed to an HSA for long-term savings while funding an FSA with just enough to cover known upcoming expenses.

FSAs represent that rare financial product that offers immediate, guaranteed returns—if you navigate the rules correctly. Like the policyholder who discovered his $300 contribution covered a year’s worth of allergy medications and his gym membership (with a doctor’s note), those who master FSAs essentially give themselves an annual raise. The key lies in understanding that these accounts aren’t just for medical emergencies—they’re strategic tools that, when used deliberately, can significantly reduce your healthcare spending while increasing your take-home pay.

References

National Institutes of Health. (2025, April 9). Flexible Spending Accounts (FSAs) – NIH: Office of Human Resources. https://hr.nih.gov/benefits/insurance/flexible-spending-accounts

Investopedia. (2024, November 11). Who benefits from a flexible spending account (FSA)? https://www.investopedia.com/ask/answers/111715/can-flexible-spending-account-fsa-be-used-spouse.asp

State University of New York Research Foundation. (2020, January 1). Flexible Spending Accounts – SUNYRF Benefits. https://benefits.rfsuny.org/regular–postdoctoral-employees/flexible-spending-accounts/

WallStreetMojo. (2024, December 19). Flexible Spending Account – Definition, Types, Benefits. https://www.wallstreetmojo.com/flexible-spending-account/