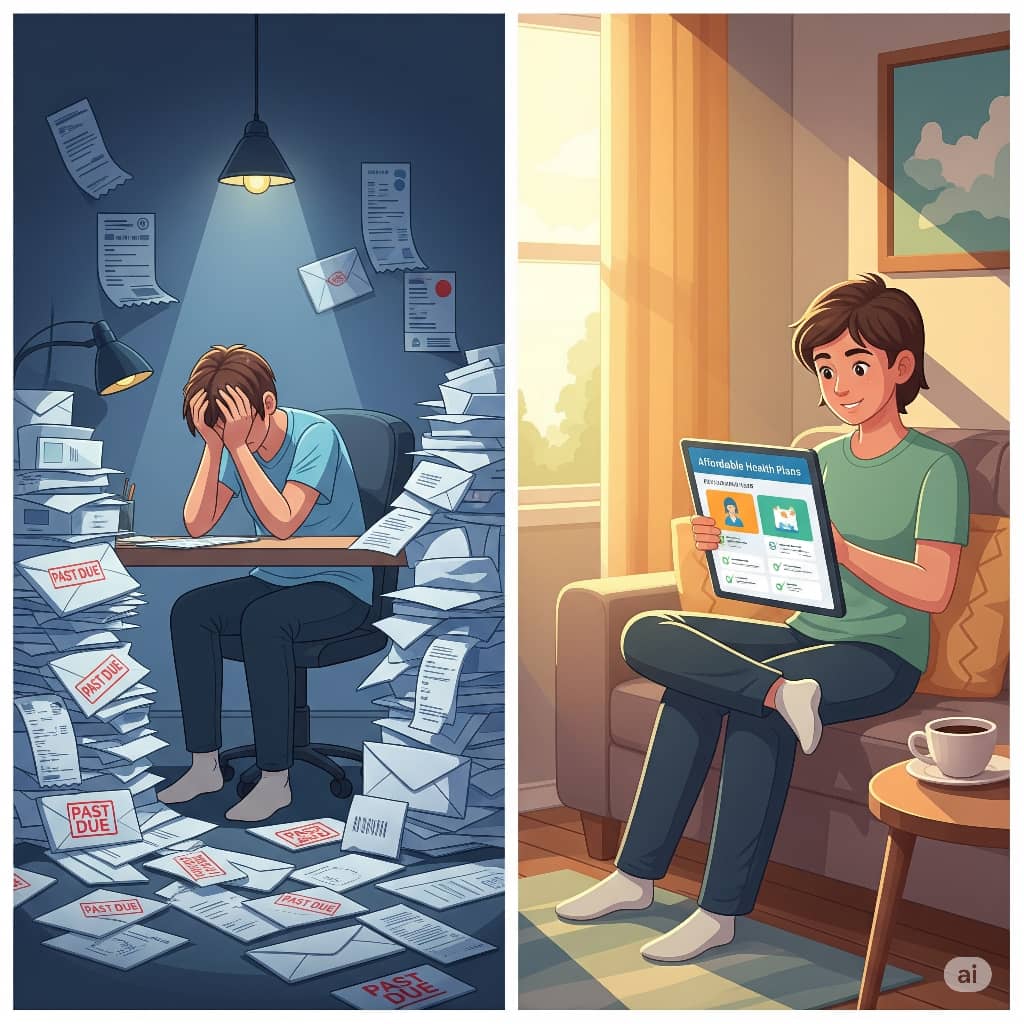

Losing your job doesn’t have to mean losing health coverage. Learn your options for maintaining insurance after employment ends and how to avoid costly coverage gaps. The day I got laid off from my marketing job, my first panicked thought wasn’t about rent or resumes, it was “What happens to my health insurance at midnight?” As I sat in my suddenly too-quiet home office, clutching the severance paperwork, I realized I had no idea how to decode the health insurance fine print. That moment of confusion launched me into a crash course on how employment and health coverage are tragically intertwined in America. What I discovered through weeks of research and interviews with benefits experts changed how I view job security forever.

Employer-sponsored health insurance operates on a brutal cliff-edge system. For many Americans, their job isn’t just a paycheck—it’s the lifeline keeping their diabetes medication affordable or their therapy sessions accessible. When that employment ends, so does the coverage, often immediately or by month’s end. I spoke to a factory worker in Ohio who delayed knee replacement surgery for years until he finally had good insurance through work only to get laid off two weeks before his scheduled procedure. His story isn’t rare. The Kaiser Family Foundation estimates nearly 30 million Americans would lose health coverage if they lost their jobs tomorrow.

COBRA seems like the obvious safety net, until you see the price tag. The law allows you to keep your employer’s group plan after job loss, but now you pay the full premium plus a 2% administrative fee. When I calculated my COBRA costs, the $1,800 monthly premium (versus the $300 I’d paid as an employee) might as well have been $18,000 on my zero-income budget. Many don’t realize COBRA can be retroactively activated within 60 days of losing coverage, a crucial option if you need time to explore alternatives or get hit with unexpected medical bills during the transition period.

The Affordable Care Act marketplace became my unexpected lifeline. Losing job-based coverage qualifies you for a Special Enrollment Period, giving you 60 days to sign up for an ACA plan regardless of the annual open enrollment calendar. With my income temporarily slashed, I discovered I qualified for substantial subsidies that made a silver plan cheaper than my former employer contribution. A freelance graphic designer I interviewed found her ACA plan actually provided better coverage for her chronic condition than her old corporate insurance had, with lower specialist copays.

Medicaid eligibility expands dramatically with lost income. Nearly 40% of Americans don’t realize job loss might qualify them for free or nearly-free coverage through this program. The catch? Expansion states (39 as of 2024) offer Medicaid to all low-income adults, while non-expansion states have stricter requirements. A single mother in Texas shared her shock at being denied Medicaid after restaurant layoffs, while her sister in New Mexico got comprehensive coverage immediately under similar circumstances. Checking your state’s Medicaid rules should be step one after job loss.

Short-term health plans tempt with low prices but come with dangerous gaps. These “band-aid” policies often exclude pre-existing conditions, prescription coverage, and mental health services—precisely when the stress of job loss makes these benefits most critical. I met an IT professional who purchased what he thought was affordable interim coverage after a layoff, only to discover his antidepressant wasn’t covered and his therapist wasn’t in-network. The $12,000 emergency room bill for his panic attack became an expensive lesson in reading fine print.

Professional associations and unions sometimes offer continuation coverage. After the local newspaper folded, journalists in my city maintained group rates through their press club’s health plan. Teachers’ unions, actor’s guilds, and even some gig worker organizations provide similar bridges between jobs. It’s worth investigating these options before individual market plans, I found my alumni association offered surprisingly robust coverage that would have cost 40% less than COBRA.

Timing matters more than most realize. Letting coverage lapse for even a month can trigger medical underwriting requirements in some states or create pre-existing condition exclusions. A construction supervisor I interviewed postponed back surgery because he missed his 60-day ACA window by three days and had to wait for open enrollment. Setting calendar reminders for deadlines protects against these costly oversights.

The psychological toll of losing health security compounds job loss stress. Studies show unemployed individuals are 30% more likely to delay needed care due to cost concerns, often worsening health outcomes. My therapist pointed out how my anxiety spiked not from the layoff itself, but from visions of medical bankruptcy—a fear that eased once I secured alternative coverage. Community health centers and hospital financial aid programs can provide stopgap care during transitions, though they’re no substitute for comprehensive insurance.

What began as my personal crisis became a revelation about systemic fragility. No other developed nation ties health coverage so tightly to employment status. The silver lining? Losing job-based insurance often pushes people to finally understand the healthcare system’s moving parts. Six months after my layoff, now working freelance with an ACA plan I love, I’m oddly grateful for that terrifying education. The peace of mind knowing I can change jobs without losing access to healthcare? Priceless.

References

U.S. Department of Labor. (2025, January 1). See your options if you lose job-based health insurance. https://www.healthcare.gov/have-job-based-coverage/if-you-lose-job-based-coverage/

U.S. Department of Labor. (2020, January 1). Continuation of health coverage (COBRA). https://www.dol.gov/general/topic/health-plans/cobra

U.S. Department of Labor. (n.d.). Protecting retirement and health benefits after job loss. https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/protecting-retirement-and-health-benefits-after-job-loss.pdf

Anthem. (2021, January 1). Health insurance for the unemployed. https://www.anthem.com/individual-and-family/insurance-basics/health-insurance/health-insurance-unemployed