Obesity can significantly impact life insurance premiums, but it doesn’t have to be a barrier to coverage. Learn how insurers assess weight, which factors matter most, and strategies to secure affordable rates. The number on the scale had never felt heavier than when I saw my life insurance quote. After years of yo-yo dieting and avoiding doctors, I finally applied for coverage, only to receive a rating that placed me in a high-risk category with premiums nearly double the standard rate. The insurance underwriter’s report cited my BMI of 34 as the primary reason, alongside slightly elevated blood pressure and cholesterol. That moment became a painful but necessary wake-up call about how insurers view weight not as a personal characteristic, but as a quantifiable risk factor with profound financial implications.

Life insurance companies approach obesity through actuarial data rather than personal judgment. Mortality tables consistently show that severe obesity (typically defined as a BMI over 35) correlates with increased risk of cardiovascular disease, diabetes, certain cancers, and other conditions that can shorten life expectancy. This statistical reality forms the basis for underwriting decisions. What many applicants don’t realize is that insurers evaluate weight within a broader context—a BMI of 33 on an athletic frame, accompanied by regular blood work, may result in better rates than a BMI of 31, which is accompanied by hypertension and prediabetes.

The body mass index (BMI) system serves as the industry’s initial screening tool, though its limitations are well-known. BMI doesn’t distinguish between muscle and fat, which means bodybuilders with minimal body fat may be classified as obese, while those with “normal” BMI scores might carry dangerous visceral fat. Progressive insurers address this by considering waist circumference measurements, which better indicate abdominal obesity, a stronger predictor of health risks than BMI alone. Some companies now even request photos or use advanced biometric data to create a more nuanced health assessment.

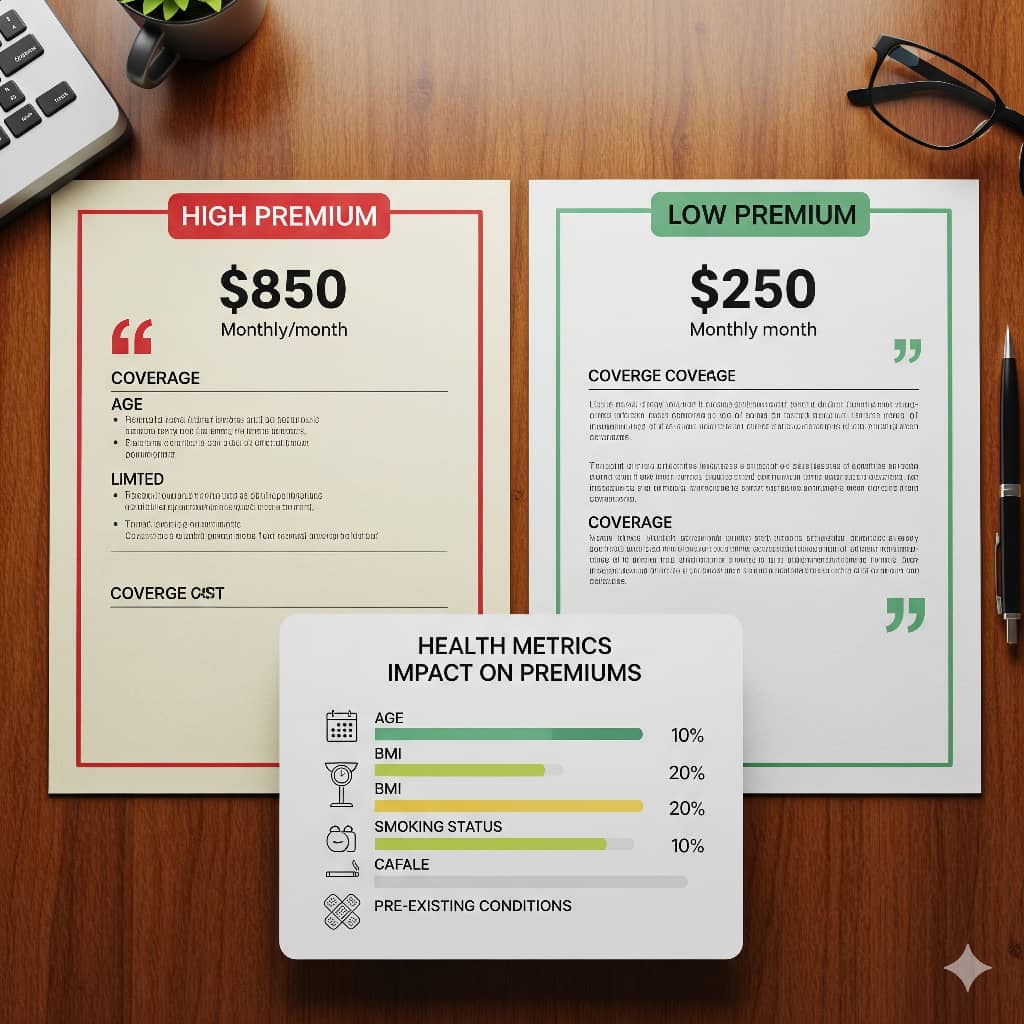

The relationship between weight and premiums follows a sliding scale rather than fixed categories. While standard rates typically apply to those with BMIs under 30, moderate increases (25-50%) often appear at BMIs 31-35. Significant premium hikes (50-100% above standard) typically apply to BMIs of 36-40. Those with BMIs above 40 may face even higher rates or limited policy options. These adjustments aren’t arbitrary; they reflect the statistical risk associated with each BMI category across millions of policyholders.

Other health metrics dramatically influence how weight affects pricing. An applicant with obesity but normal blood pressure, cholesterol, and blood sugar will likely receive better rates than someone at the same BMI with metabolic issues. This explains why two people with identical weights might receive vastly different quotes. One of my clients with a BMI of 38 obtained standard rates because he maintained excellent cardiovascular fitness and regular metabolic markers; his annual physical demonstrated that his weight wasn’t currently impacting his health.

Timing and preparation can significantly improve outcomes. I advise clients to schedule insurance exams in the morning after fasting for 12 hours to ensure optimal glucose and cholesterol readings. Avoiding strenuous exercise for 24 hours before blood work helps prevent artificially elevated liver enzymes. Even minor improvements in test results can sometimes move applicants into a better rate class, potentially saving thousands over the policy’s lifetime.

Policy type selection becomes crucial for applicants with higher risk profiles. While traditional fully underwritten policies offer the best rates for healthy individuals, simplified issue policies (which don’t require medical exams) might be more accessible for those with obesity-related health issues. The trade-off comes in higher per-dollar costs and lower maximum coverage amounts. Guaranteed issue policies provide another alternative for those who’ve been declined elsewhere, though they typically have waiting periods before full coverage takes effect.

The strategic use of follow-up exams can lead to premium reductions. Many insurers allow policyholders to request reconsideration after demonstrating improvements in their health. One client lost 40 pounds over a two-year period through medically supervised weight management. Her subsequent re-evaluation resulted in a 30% premium reduction, saving her over $600 annually while improving her long-term health outlook.

Insurance shopping is significant for applicants with obesity. Company underwriting guidelines vary significantly—some insurers are more weight-friendly than others. An independent broker can match applicants with carriers known for more favorable ratings on obesity. I recently helped a client with a BMI of 39 obtain coverage at only 25% above standard rates by targeting insurers that place greater emphasis on overall health metrics rather than weight alone.

Long-term planning should include potential rate improvements. Some applicants choose to purchase a smaller policy initially with plans to reapply for additional coverage after weight loss. Others use term policies to bridge them until they qualify for better rates. The key is maintaining coverage during weight loss journeys rather than going uninsured while working toward health goals.

The emotional aspect of weight-based rating deserves acknowledgment. Many applicants feel judged or discouraged by higher premiums. Framing these ratings as motivational rather than punitive can be helpful. One client used his premium increase as concrete motivation to lose weight, ultimately improving his health while saving money. Supportive insurers often provide resources for weight management programs, recognizing that enhanced health benefits are beneficial to both policyholders and the company.

Obesity doesn’t have to prevent anyone from obtaining life insurance coverage. By understanding how insurers assess weight, preparing thoroughly for medical exams, shopping strategically among carriers, and planning for future improvements, applicants can secure protection for their families while working toward better health. The process requires patience and persistence, but affordable coverage is often within reach, even for those beginning their wellness journeys.

References

Camargo Insurance. (n.d.). How your weight affects your life insurance costs. https://camargoinsurance.com/blog/how-your-weight-affects-your-life-insurance-costs

This source explains that life insurers use Body Mass Index (BMI) to assess overweight and obesity, which can significantly increase premiums or result in denial of coverage due to associated health risks such as heart disease, diabetes, and stroke.

Veritas Risk Management. (2024, May 23). How your weight affects life insurance costs. https://veritasrm.com/how-weight-affects-life-insurance-costs/

This article outlines the BMI categories insurers consider and the impact of each on premiums, noting that obesity (BMI 30+) results in substantially higher costs or coverage restrictions.

Protect Your Wealth. (2025, May 6). How to Get Affordable Life Insurance with Obesity. https://protectyourwealth.ca/world-obesity-day-how-to-get-affordable-life-insurance-with-obesity/

It highlights underwriting factors, such as health history, age, lifestyle, and treatment management, that influence the affordability and availability of coverage for individuals with obesity.

Extend Finance. (2025, April 29). How does BMI affect the cost of life insurance? https://extendfinance.co.uk/how-does-bmi-affect-the-cost-of-life-insurance/

This source provides statistics on premium increases by BMI ranges and the greater financial impact on younger applicants, as well as coverage implications.

Insuranceopedia. (2025, January 13). A guide to life insurance for obese people. https://www.insuranceopedia.com/a-comprehensive-guide-to-life-insurance-for-overweight-and-obese-people

It offers practical advice on securing coverage despite obesity, factors considered by insurers, potential premium adjustments, and the importance of consulting with specialists.