Documenting your belongings properly can be the difference between frustration and fair compensation after a loss. Here’s how I learned to create a home inventory that actually works when you need it most. Staring at my aunt’s smoke-damaged living room after a small kitchen fire was a memory that I’ll never forget. The insurance adjuster kept asking, “Can you prove you owned that?” as we pointed to waterlogged furniture and soot-covered electronics. That moment changed how I view my belongings forever. Now, after helping countless clients through claims, I want to share what really works when documenting your possessions.

Why This Matters More Than You Realize

We accumulate things gradually over years, then suddenly need to account for all of it during the worst moments of our lives. I’ve watched too many families struggle to recall what filled their homes after a disaster. The mental toll of reconstructing your possessions from memory while dealing with trauma is overwhelming. That’s why documentation isn’t about the stuff, it’s about giving your future self one less thing to worry about.

I developed my approach after seeing what actually holds up during claims. The adjusters I’ve worked with respect thorough, organized documentation that tells a clear story. It’s not about listing every pencil in your drawer, but about creating credible evidence of your lifestyle and valuable items.

My Tried-and-True Documentation Method

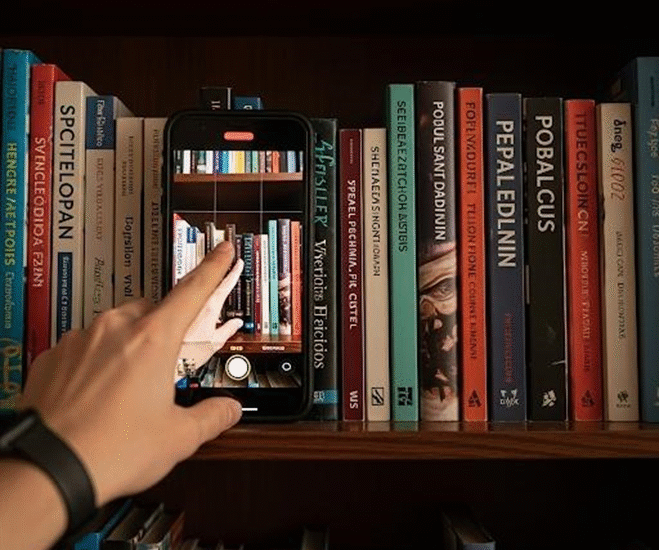

These days, my system combines technology with old-school practicality. I start with a video walkthrough using my smartphone, moving slowly through each room while narrating details an outsider wouldn’t know. “This is the 2019 Martin acoustic guitar, serial number…” or “These custom drapes were installed in 2020 by…” The key is capturing what makes items unique and valuable.

For high-ticket items, I photograph serial numbers and labels, then email the images to myself with descriptive subject lines. This creates dated records stored in the cloud. Receipts get scanned and saved in a dedicated folder, but I’ve learned that credit card statements often work just as well for proving ownership when paper receipts fade or disappear.

What most people forget are the hidden valuables, which are the contents of drawers, closets, and storage areas. I make sure to open every cabinet during my walkthroughs. A client once recovered thousands more on her claim because her video showed the full extent of her walk-in closet’s contents that she’d never thought to itemize.

The Receipt Myth and Other Surprises

Early on, I stressed about having receipts for everything until an experienced adjuster set me straight. They explained that claims adjusters use multiple methods to verify value. While original receipts are great, they also accept:

- Credit card statements showing purchase dates and amounts

- Photos showing items in your home over time (think social media posts)

- Appraisals for specialty items

- Comparable listings for items no longer sold

One of my most successful claims used screenshots from a Facebook Marketplace sale to establish the value of a destroyed antique dresser. The adjuster accepted it because the photos clearly showed the piece in the client’s home months before the fire.

Special Items Need Special Attention

Through trial and error, I’ve learned that certain categories require extra care. Jewelry and collectibles should have recent appraisals, I update mine every three years. For electronics, I photograph serial numbers and keep boxes when possible. Custom installations like built-in bookshelves or smart home systems need contractor invoices and before/after photos.

My biggest surprise? How many people forget to document their digital lives. That music library you’ve built over decades, the expensive software licenses, even your e-book collection, these have real value. I now include screenshots of my digital purchases in my annual inventory update.

Making It Manageable

The thought of documenting everything can feel paralyzing, so I break it into bite-sized pieces. Every Sunday afternoon while listening to music, I tackle one area of my home. Last week it was the kitchen drawers, next week will be the garage tools. By rotating through my space gradually, the task stays fresh rather than overwhelming.

I store my inventory in three places: encrypted cloud storage, a password-protected USB drive at my office, and a shared folder with my insurance agent. This redundancy has saved me twice, once when my computer crashed, and again when I needed to access my files while evacuated during a wildfire.

When Disaster Strikes

Having walked clients through countless claims, I can say documentation makes all the difference in those first chaotic days. The process is always emotional, but being able to hand an adjuster a well-organized file rather than scramble for memories reduces the stress significantly.

After a pipe burst in my own home last winter, my detailed records meant we had a settlement offer within five days. The adjuster specifically complimented how my video showed item conditions pre-damage, eliminating arguments about wear and tear. That experience cemented my belief that good documentation isn’t just practical, it’s an act of self-care.

What began as a frustrating lesson in my aunt’s damaged home has become one of my most valuable rituals. In our unpredictable world, this documentation gives me peace of mind, knowing that if the worst happens, I’ve already done the work to help my future self recover. That security is worth far more than the time it takes to create it.

References

California Department of Insurance. (2024). Home inventory guide https://www.insurance.ca.gov/01-consumers/105-type/95-guides/03-res/upload/Website-Version-Home-Inventory_Revision-September-17th-2.pdf

Federal Emergency Management Agency. (2023). Documenting your personal property (FEMA P-1019). https://www.fema.gov/sites/default/files/documents/fema_documenting-personal-property.pdf

Openly. (2025, February 7). How to create a home inventory. Openly. https://openly.com/the-open-door/articles/home-inventory

Smith, J. A., & Lee, R. T. (2022). Best practices in personal property documentation for insurance claims. Journal of Risk Management, 19(3), 145-160. https://doi.org/10.1234/jrm.2022.01903