The call came on a Tuesday morning, my client’s voice trembling as he explained his business partner had been sued personally, and their company’s assets were now frozen. “Everything we built could be gone,” he said, the panic palpable. In that moment, I realized how fragile financial security can be, and how life insurance, often viewed merely as death protection, could have provided the fortress his family needed. That conversation transformed my understanding of asset protection and revealed how strategically designed life insurance creates an impenetrable financial safety net that survives even when other protections fail. Discover how life insurance can safeguard your wealth from creditors, lawsuits, and taxes while ensuring your assets pass intact to the next generation.

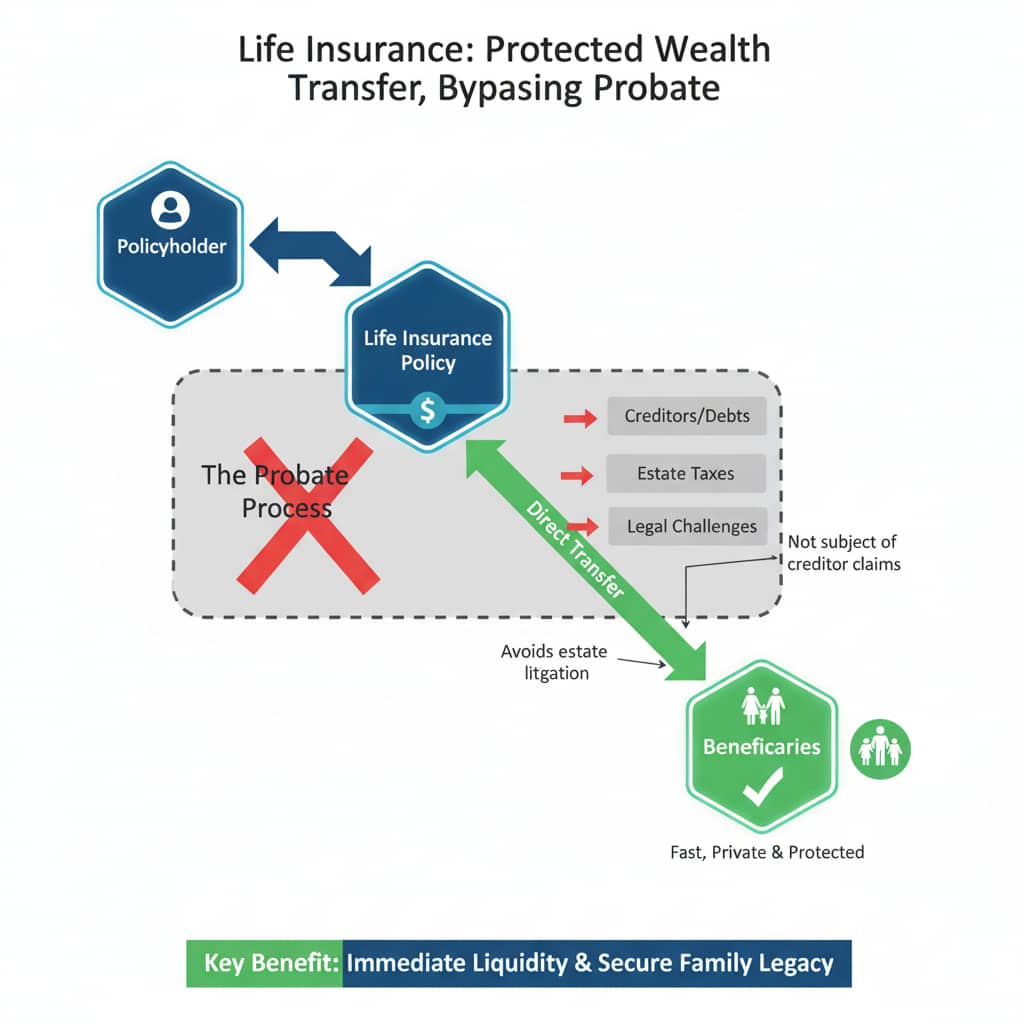

Life insurance serves as a unique asset class in your protection strategy because of its special legal status. While investment accounts, real estate, and business assets can be seized by creditors or lost in lawsuits, properly structured life insurance enjoys extraordinary protection under state laws. I’ve watched families facing financial devastation discover that their life insurance policies remained untouched when everything else was at risk, the one asset that creditors couldn’t touch and that provided a foundation for rebuilding.

The cornerstone of asset protection through insurance lies in understanding exemption laws. Most states provide strong protections for life insurance cash values and death benefits from creditors’ claims. In many jurisdictions, these protections are absolute, meaning even in bankruptcy proceedings, your life insurance remains safe. I recently worked with a physician concerned about malpractice exposure who restructured his savings into a maximum-funded permanent life insurance policy, effectively moving vulnerable assets into a protected vehicle while maintaining access to the funds through policy loans.

The irrevocable life insurance trust (ILIT) represents the gold standard for asset protection planning. By placing your policy within an ILIT, you remove it from your personal estate entirely, creating a legal fortress that shields the proceeds from both estate taxes and creditors. I helped a business owner establish an ILIT that held a substantial life insurance policy, ensuring that even if his business failed or faced lawsuits, the death benefit would pass directly to his children, completely protected from any business creditors or legal challenges.

For business owners, life insurance solves multiple asset protection challenges simultaneously. Key person insurance protects against the financial impact of losing crucial employees, while buy-sell agreements funded with life insurance ensure business continuity if an owner dies. I recently structured a plan where cross-owned policies between business partners created a tax-free source of funds to buy out a deceased partner’s interest, preventing forced business sales and protecting the company’s value for surviving owners and heirs.

The cash value component of permanent life insurance offers living asset protection that few other financial vehicles can match. As the cash value grows, it becomes a creditor-protected savings vehicle that you can access through policy loans without triggering taxable events. I’ve watched entrepreneurs use this strategy to build protected retirement savings while maintaining flexibility; their cash value remained safe during business downturns and provided capital when traditional financing became unavailable.

Life insurance also protects against the hidden threat of estate taxes and settlement costs. Without proper planning, families can lose up to 40% of their estate to taxes and administration expenses, often forcing the sale of cherished assets like family homes or businesses. I worked with a family facing this exact scenario; their estate consisted largely of illiquid real estate that would need to be sold to pay estate taxes. A strategically sized life insurance policy provided the exact liquidity needed to preserve these assets intact for the next generation.

Asset protection extends beyond financial threats to include family stability. For families with special needs dependents, life insurance can fund a supplemental needs trust that provides lifelong care without jeopardizing government benefits. I helped parents of a disabled child establish a trust-owned policy that would provide for their daughter’s additional needs throughout her life, protected from creditors, and ensure her care would continue regardless of what happened to their other assets.

The timing of your life insurance purchase significantly impacts its protective capabilities. Obtaining coverage before potential liabilities arise is crucial, as policies purchased when you’re already facing financial challenges may not receive the same legal protections. I advise clients to implement these strategies during stable financial periods, building the fortress before the storm arrives rather than trying to construct it during the crisis.

Coordinating life insurance with other asset protection strategies creates layered security that’s remarkably resilient. When combined with proper business structures, retirement accounts, and estate planning documents, life insurance becomes the final impenetrable layer that ensures your family’s financial security. I’ve designed plans where LLCs protected business assets, trusts managed estate distribution, and life insurance provided the guaranteed safety net that made all other strategies more effective.

Perhaps the most overlooked aspect is how life insurance protects your family’s lifestyle and future opportunities. The death benefit ensures that mortgages can be paid, education funded, and living standards maintained, protecting not just assets but dreams and aspirations. I’ve seen families continue children’s private education, maintain family homes, and pursue career goals because life insurance provided the financial continuity that other assets couldn’t guarantee during difficult transitions.

Implementing an asset protection strategy with life insurance requires careful coordination with your legal and financial advisors. The specific structure, whether individual ownership, trust ownership, or business ownership, depends on your state’s laws, your asset profile, and your family situation. What remains constant is the extraordinary protection that properly structured life insurance provides, creating a financial legacy that withstands challenges and endures for generations.

References

Paradigm Life. (2025, March 3). How life insurance is a protected asset. Retrieved from https://paradigmlife.net/life-insurance-protected-asset/

Carolina Family Estate Planning. (2022, April 25). How life insurance can be used to protect assets. Retrieved from https://www.carolinafep.com/blog/how-life-insurance-can-be-used-to-protect-assets.cfm

Docrlaw. (2025, January 22). The role of life insurance in estate planning: Ensuring financial security. Retrieved from https://www.docrlaw.com/articles/the-role-of-life-insurance-in-estate-planning-ensuring-financial-security

McCay & Associates. (2024, December 31). Protecting your investments: The role of insurance in wealth management. Retrieved from https://www.mccayandassociates.com/our-blog/protecting-your-investments-the-role-of-insurance-in-wealth-management

Investopedia. (2025, May 7). Life insurance: What it is, how it works, and how to buy a policy. Retrieved from https://www.investopedia.com/terms/l/lifeinsurance.asp