The Surprise Bill That Changed Our Pregnancy Journey

Expecting a baby? Learn how to maximize your health insurance benefits for prenatal care, delivery, and newborn medical needs. When Sarah and Michael received a $5,000 hospital bill after their daughter’s birth despite having “good” insurance, they realized too late that their plan required pre-authorization for delivery at their preferred hospital. This stressful financial surprise is far too common among new parents, but with proper planning, you can avoid similar pitfalls.

Understanding how to use health insurance for maternity and newborn care requires knowing what to ask, when to ask it, and how to navigate the fine print that determines what you’ll pay out of pocket. Here’s what every expecting parent should know.

Early Pregnancy Planning with Insurance in Mind

The moment you consider starting a family or learn you’re pregnant, contact your insurance provider to request detailed maternity benefits information. Ask specific questions about network requirements for obstetricians, hospitals, and pediatricians. Some plans mandate using affiliated birth centers or require pre-approval for certain prenatal tests.

Review your policy’s deductible and out-of-pocket maximums carefully. Many families hit their annual maximums with delivery costs alone, meaning subsequent newborn care may be fully covered. Estimate your total expected costs by adding prenatal visits, delivery fees, and potential complications to determine if switching plans during open enrollment makes financial sense.

Maximizing Prenatal Care Coverage

Most health plans must cover essential prenatal services under the Affordable Care Act, but the specifics vary. Routine ultrasounds and bloodwork typically fall under preventive care when medically necessary, while elective genetic testing might incur additional costs.

Ask your obstetrician to code visits appropriately. A “sick visit” for morning sickness management might apply to your deductible differently than a standard prenatal checkup. Keep detailed records of all services received and compare them against explanation of benefits statements to catch billing errors early.

Consider whether your plan covers alternative care options like doula services or lactation consultants. Some insurers now recognize these as cost-effective ways to improve birth outcomes and reduce complications.

Preparing for Delivery Costs

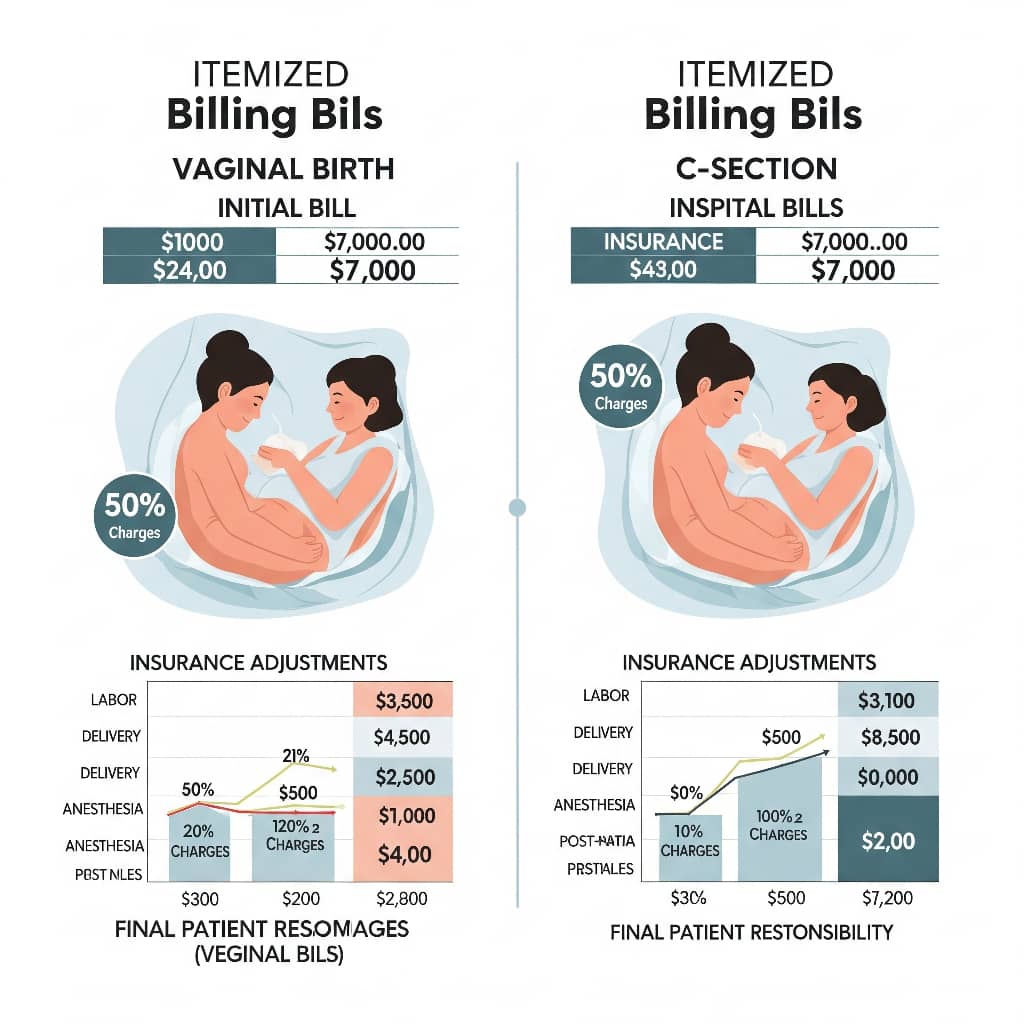

Hospital delivery charges vary wildly, with uncomplicated vaginal births costing $5,000 to $15,000 and C-sections reaching $25,000 or more. Your insurance plan’s negotiated rates will determine your actual responsibility.

Verify whether your anesthesiologist and pediatrician are in-network, as out-of-network providers attending your delivery can lead to surprise bills. Some states now protect against this through balance billing laws, but coverage varies.

Understand how your plan handles complications. Some classify emergency C-sections differently than scheduled ones, affecting your cost sharing. Ask about room upgrades too, that private delivery suite might seem appealing until you learn it’s not covered.

Newborn Care and Insurance Logistics

You typically have 30 days to add your newborn to your insurance policy, but coverage should begin at birth. Retroactive claims are possible but risky, submit paperwork immediately.

Well-baby visits and vaccinations are generally covered as preventive care, but NICU stays follow different rules. Some plans charge a separate deductible for newborns, while others apply the baby’s medical costs to the mother’s deductible until formally enrolled.

If both parents have separate insurance, compare which plan offers better pediatric coverage before enrolling the baby. Some families strategically time births near the end of the calendar year to maximize having met deductibles, then reset coverage for the new year when well-baby visits begin.

Navigating maternity and newborn coverage requires proactive planning, but the effort pays off in reduced stress and financial protection during this life-changing chapter. By understanding your benefits early, asking detailed questions, and documenting every step, you can focus on what truly matters—welcoming your new family member with confidence and joy. Remember, your insurance company’s customer service representatives can be valuable resources when you know what to ask. Don’t hesitate to call multiple times until you get clear answers that put your mind at ease.

References

Forbes Advisor. (2025). Best health insurance for pregnant women of 2025. Forbes. https://www.forbes.com/advisor/health-insurance/best-health-insurance-for-pregnant-women/

Pulse Nigeria. (2025, May 7). Top health insurance that covers antenatal and maternity care in Nigeria. https://www.pulse.ng/articles/pulse-picks/health-insurance-for-maternity-care-2025050712433834141

HealthCase Services. (2025, May 18). World Health Day 2025: Reducing maternity costs. https://healthcaseservices.com/world-health-day-2025-reducing-maternity/

GoDigit Insurance. (2025, February 3). Buy health insurance policy with maternity coverage online in 2025. https://www.godigit.com/health-insurance/health-insurance-with-maternity-cover