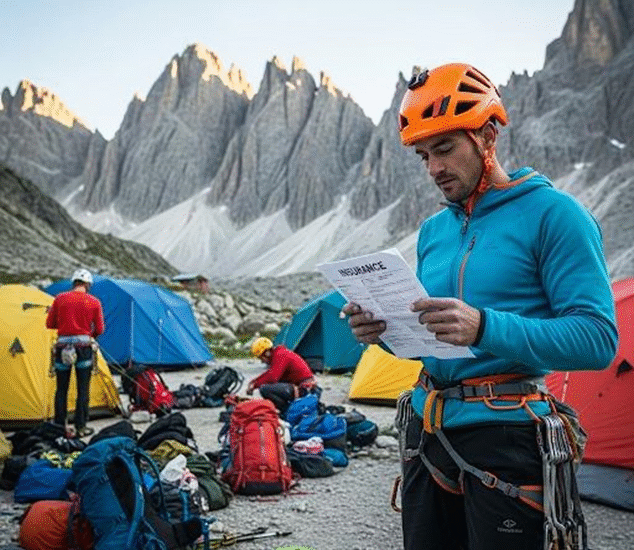

Adventure tourism is reshaping travel insurance needs. Find out how extreme activities impact coverage, premiums, and what thrill-seekers must know to stay protected on their journeys. The email arrived at 2:37 AM from a client stranded in a Nepalese hospital. His paragliding accident, a tangled canopy sending him crashing into hillside trees wasn’t covered by his standard travel policy. As I scrambled to arrange emergency funds for his medical evacuation, I realized how many adventure enthusiasts unknowingly travel with worthless insurance. That moment changed how I advise clients about travel coverage forever.

The Growing Gap Between Thrills and Coverage

Adventure tourism has exploded, with the global market projected to hit $1.3 trillion by 2030. Yet most travelers don’t realize their zip-lining excursion in Costa Rica or canyoning adventure in Switzerland voids standard policies. I’ve seen claims denied for injuries sustained during activities as common as snorkeling (deemed “hazardous” by some insurers) or even hot air ballooning (excluded in 60% of basic policies).

The disconnect stems from how insurers categorize risk. That whitewater rafting trip you consider a bucket-list experience? Insurers see a 17-times higher injury rate than conventional tourism. My most heartbreaking case involved a family denied $200,000 in medical bills after their teen daughter broke her spine bungee jumping, an exclusion buried in page 37 of their policy.

How Insurers Are Adapting Slowly

The insurance industry’s response has been uneven. Some specialty providers now offer modular “adventure packs,” while mainstream insurers quietly tighten exclusions. I recently compared two nearly identical policies where rock climbing coverage differed dramatically, one covered indoor gyms only, while another included outdoor climbs up to 6,000 meters.

Premium adjustments reflect this risk calculus. Adding adventure coverage typically increases trip costs by 8-15%, but I’ve seen spikes of 50% for activities like BASE jumping or cave diving. More surprisingly, some insurers now factor in destination risks, the same heli-skiing excursion costs less to insure in New Zealand (with strict operator regulations) than in developing nations with lax safety standards.

The Fine Print That Matters Most

Three often-overlooked policy elements make or break adventure travel coverage:

Equipment Protection

Standard policies rarely cover gear loss or damage. A client’s $15,000 camera rig destroyed in a mountaineering fall wasn’t covered until we found a specialty insurer offering equipment riders.

Emergency Extraction

That helicopter rescue from the backcountry? Many policies cap evacuation costs or exclude “self-inflicted risk” scenarios. I now insist clients verify extraction coverage matches their activity’s remoteness.

Altitude Exclusions

Most policies void above certain elevations usually 3,000-4,500 meters. A trekker’s pulmonary edema treatment was denied because his Everest Base Camp hike exceeded his policy’s 5,000-meter limit.

Building a Smarter Safety Net

After helping hundreds of adventure travelers, I’ve developed a checklist for adequate protection:

Activity-Specific Verification

Never assume, get written confirmation your exact activities are covered. “Mountaineering” might include trekking but exclude technical climbing.

Operator Vetting

Insurers often deny claims involving unlicensed operators. I maintain a global list of outfitters meeting insurance standards.

Medical History Transparency

Undisclosed conditions like asthma or heart issues can void claims. One client’s diving medical was denied due to an unreported childhood arrhythmia.

Documentation Protocols

I teach clients to photograph gear pre-trip and obtain incident reports immediately after accidents, time-stamped evidence that’s resolved multiple claim disputes.

When Things Go Wrong

Real-world claims reveal uncomfortable truths. That client in Nepal? We eventually recovered costs through his adventure sports membership (which included secondary coverage), but the process took nine months. Another traveler’s rock climbing fall became a legal battle when the insurer argued his “free solo” ascent violated policy terms, a $300,000 lawsuit that hinged on defining “roped versus unroped” climbing.

The smoothest claims share three traits: clear activity documentation, immediate incident reporting, and pre-arranged medical networks. Clients who register their adventures through providers like Global Rescue or DAN (Divers Alert Network) typically experience faster, less contentious resolutions.

The Future of Adventure Coverage

Emerging solutions give me hope. Usage-based “micro-policies” now cover single activities by the hour, while blockchain-enabled smart contracts automatically validate claims using geolocation data. Some insurers even offer premium discounts for verified safety training. I recently secured a 20% reduction for a client who completed avalanche certification courses.

Yet the fundamental challenge remains: adventure travelers must recognize insurance isn’t about preventing experiences, but about protecting their ability to keep having them. As I tell every thrill-seeking client, your courage shouldn’t extend to gambling with uncovered risks. That paragliding client? He’s now summited six more peaks, each time with specialty coverage vetted by our team. The adventure continues, just with better safety nets.

True adventure isn’t about recklessness, it’s about calculated risks with proper preparation. The right insurance coverage lets explorers push boundaries while knowing someone’s got their back when gravity (or luck) turns against them. After all, the best stories come from adventures you survive to recount.

References

Verified Market Reports. (2025, February 18). Adventure Sports Travel Insurance Market Size, SWOT, Growth and Forecast 2026-2033. https://www.verifiedmarketreports.com/product/adventure-sports-travel-insurance-market/

Market Research Intellect. (2024, December 2). Adventure Sports and Financial Safety: The Growth of Travel Insurance in High-Risk Activities. https://www.marketresearchintellect.com/fr/blog/adventure-sports-and-financial-safety-the-growth-of-travel-insurance-in-high-risk-activities

Data Insights Market. (2024, July 4). Extreme Sports Travel Insurance: Navigating Dynamics and Growth. https://www.datainsightsmarket.com/reports/extreme-sports-travel-insurance-1395708

Business Research Insights. (2025). Adventure Sports Travel Insurance Market Share [2025-2033]. https://www.businessresearchinsights.com/market-reports/adventure-sports-travel-insurance-market-116804