Your physical location significantly impacts health insurance costs. Discover how zip codes affect premiums and ways to find affordable coverage in your area. I’ll never forget the shock on my cousin’s face when she moved from Portland to Phoenix and her health insurance premium nearly doubled overnight. “It’s the same me,” she protested to the insurance agent. “Same health history, same lifestyle.” The agent’s response? “But not the same zip code.” That moment revealed what many Americans don’t realize which is that your physical address can impact your health coverage costs as much as your medical history.

The Hidden Geography of Healthcare Pricing

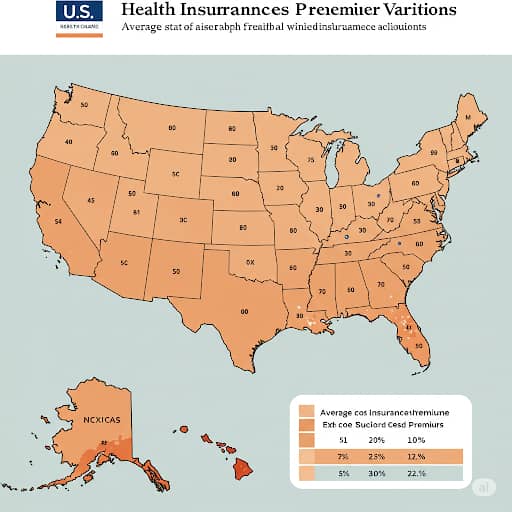

Health insurance premiums fluctuate wildly based on location because medical care itself costs different amounts in different places. A routine procedure that costs a few hundred dollars in one city might carry a price tag several times higher just a few counties over. Through my work advising clients across the country, I’ve seen firsthand how rural residents often pay significantly more for less robust coverage simply because their regions have fewer providers competing for patients.

These geographic disparities stem from complex factors. Urban areas with multiple hospital systems typically enjoy more competitive pricing structures. States that embraced Medicaid expansion under the Affordable Care Act generally offer lower marketplace premiums. Even within the same metropolitan area, insurance costs can vary based on neighborhood demographics and local health trends that insurers carefully track.

The Rural Healthcare Dilemma

Living outside major population centers often carries an invisible surcharge on health coverage. One farmer client of mine pays 40% more for his family’s insurance than his brother in Chicago, despite having fewer health issues overall. Rural communities face a perfect storm of challenges when it comes to healthcare costs, with fewer insurance carriers willing to offer plans in their markets. The cruel paradox is that many rural policyholders pay higher premiums while simultaneously needing to travel greater distances and absorb more out-of-pocket expenses to access care.

When State Lines Divide Costs

State regulations create dramatic premium differences across borders. A client who relocated from Colorado to Texas saw her monthly premium increase by $175 for nearly identical coverage. This jump stemmed from Texas’s decision not to expand Medicaid and different insurance regulations that shifted costs to consumers.

Some states have implemented innovative solutions to control costs. Maryland’s unique hospital rate-setting system has maintained relatively stable premiums, while Minnesota’s reinsurance program succeeded in lowering marketplace plan costs by significant percentages. These regional approaches demonstrate how policy decisions directly impact what residents pay for coverage.

The Neighborhood Premium Effect

Insurers analyze hyper-local data that can affect your rates, including neighborhood emergency room utilization patterns, prevalence of chronic diseases, and availability of providers. A Miami teacher I assisted successfully challenged a 20% premium hike by demonstrating her apartment building’s zip code had been incorrectly grouped with a higher-risk area several blocks away.

Navigating Location-Based Costs

While relocating solely for better insurance rates isn’t practical for most, there are strategies to mitigate geographic disadvantages. Comparing all available plans during open enrollment periods is crucial, as network sizes and pricing can vary significantly. Telehealth options have become increasingly valuable for rural residents facing provider shortages.

One remote worker client found significant savings by switching to a plan that recognized his frequent medical visits to his parents’ urban area, allowing him to use that address for primary coverage purposes. His $1,200 annual savings demonstrated how creative solutions can sometimes offset location-based cost challenges.

References

American Academy of Actuaries. (2024, August). Drivers of 2025 health insurance premium changes [PDF].

Chen, Y. (2025). Health, health insurance, and inequality. International Economic Review, 66(1).