Learn how deductibles and co-pays determine your healthcare costs and how to choose the right insurance plan for your needs without financial surprises. When I broke my wrist last year, I thought my “good” insurance would cover most of the emergency room visit. Then the bills came, $1,200 for the initial treatment and X-rays, plus another $75 for follow-up care. That’s when I truly understood what my insurance agent had tried to explain: deductibles and co-pays aren’t just fine print details; they form the financial foundation of every health insurance policy.

These two cost-sharing mechanisms work together to determine what you pay versus what your insurance covers. Understanding how they interact can help you avoid financial surprises and select the right plan during open enrollment.

Deductibles: Your Upfront Healthcare Costs

A deductible represents the amount you must pay out of pocket for covered healthcare services before your insurance begins sharing costs. Think of it as your annual healthcare entry fee. If your plan has a $2,000 deductible, you’re responsible for the first $2,000 in eligible medical expenses each year before your insurance starts paying its portion.

Deductibles reset annually, typically at the start of each calendar year. Some plans implement separate deductibles for different services, meaning you might have one deductible for medical care and another for prescription medications. Importantly, preventive care services like annual check-ups and routine screenings are usually covered in full, even before you’ve met your deductible.

Co-Pays: Your Share of Service Costs

Co-pays are fixed amounts you pay for specific healthcare services after meeting your deductible, though some plans require co-pays even before the deductible is satisfied. These predictable fees, such as $25 for primary care visits or $50 for specialist consultations, help you budget for routine healthcare expenses.

Some insurance plans use co-insurance instead of flat co-pays. Co-insurance represents a percentage of the service cost rather than a fixed amount, typically applying to more expensive services like hospital stays or advanced imaging tests.

How Deductibles and Co-Pays Work Together

The relationship between these cost-sharing elements determines your actual healthcare spending throughout the year.

Before meeting your deductible, you generally pay the full cost for most healthcare services, though some plans offer pre-deductible co-pays for basic preventive care. Once you’ve satisfied your deductible, you typically only pay the designated co-pays or co-insurance until you reach your plan’s out-of-pocket maximum. After hitting this spending cap, your insurance covers 100% of remaining eligible expenses for the year.

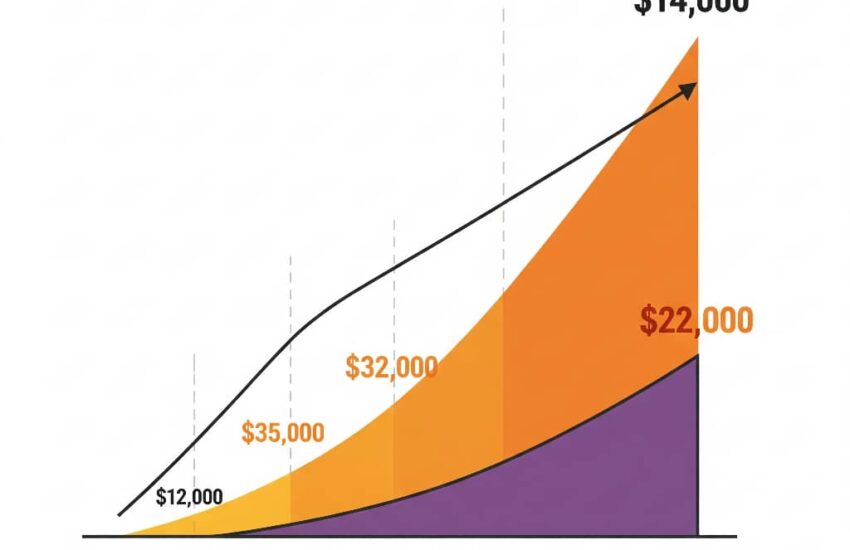

High-deductible health plans feature lower monthly premiums but require you to pay more upfront for care. Low-deductible plans cost more each month but begin sharing costs earlier in the healthcare process.

Choosing the Right Plan for Your Situation

Selecting between high and low deductible plans requires careful consideration of your expected healthcare needs.

High-deductible health plans often work well for generally healthy individuals who rarely need medical care, those who can comfortably afford the higher deductible in case of emergencies, and people who want to take advantage of health savings accounts.

Low-deductible plans typically better serve families with frequent doctor visits, individuals managing chronic health conditions, and those who prefer predictable, smaller payments spread throughout the year rather than large upfront costs.

Understanding how deductibles and co-pays work transforms health insurance from a confusing obligation into a valuable financial planning tool. By grasping these fundamental cost-sharing mechanisms, you can make informed decisions during open enrollment, better anticipate medical expenses, and avoid unexpected bills. Remember, the best insurance plan isn’t necessarily the one with the lowest deductible or co-pay, it’s the one that aligns with both your health requirements and financial circumstances.

References

British Columbia Centre for Disease Control. (2005). British Columbia pandemic influenza preparedness plan: Guidelines for planning, response and recovery. http://www.pep.bc.ca/hazard_plans/BC_PI_Plan_Fina1_PAB_REVISED-AUG.pdf

Statistics Canada. (2015). The impact of mental health problems on family members. https://www150.statcan.gc.ca/n1/pub/82-624-x/2015001/article/14214-eng.pdf

House of Commons Canada. (2013, February). Tax incentives for charitable giving in Canada: Report of the Standing Committee on Finance, 41st Parliament, 1st Session (Report No. 15). https://www.ourcommons.ca/DocumentViewer/en/41-1/FINA/report-15

U. S. Food and Drug Administration/Center for Drug Evaluation and Research. (2004). Worsening depression and suicidality in patients being treated with antidepressant medications: FDA public health advisory. https://www.fda.gov/media/70042/download

Moradi-Lakeh, M., & Vosoogh-Moghaddam, A. (2020). Deductibles in health insurance, beneficial or detrimental. Medical Journal of the Islamic Republic of Iran, 34, 19. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7475628/

Rembrandt, V. (2024). Understanding attachment-based therapy: A path to healing through relationships. Trauma & Acute Care, 9(2), 19. https://doi.org/10.36648/2476-2105-9.2.19

Lewicki, R. J., Saunders, D. M., & Barry, B. (2023). Negotiation (9th ed.). McGraw-Hill Education.