Why does life insurance cost more as you age? Find out the surprising truth, and also smart ways to save before it’s too late. You know how everyone says, “Age is just a number”? Well, try telling that to a life insurance company. Spoiler: They do not agree.

I remember when I first started looking into life insurance in my late 20s. Back then, I figured I had all the time in the world, why rush? Fast forward a few years, and suddenly, those premium quotes started creeping up. Not by a little, either. We are talking noticeable jumps. And that got me thinking: Why does age have such a massive impact on life insurance costs? And more importantly, what can we actually do about it?

The Cold, Hard Truth: Older equals More Expensive

Let us be real, insurance companies are not in the business of losing money. The older you get, the higher the chances ‘statistically speaking’ that they will have to pay out a claim. It is not personal; it is just math.

Think of it like car insurance. A 16-year-old with a brand-new license? Sky-high rates. A 40-year-old with a clean driving record? Much better deal. Life insurance works the same way, except instead of worrying about your driving skills, they are calculating how long you are likely to stick around.

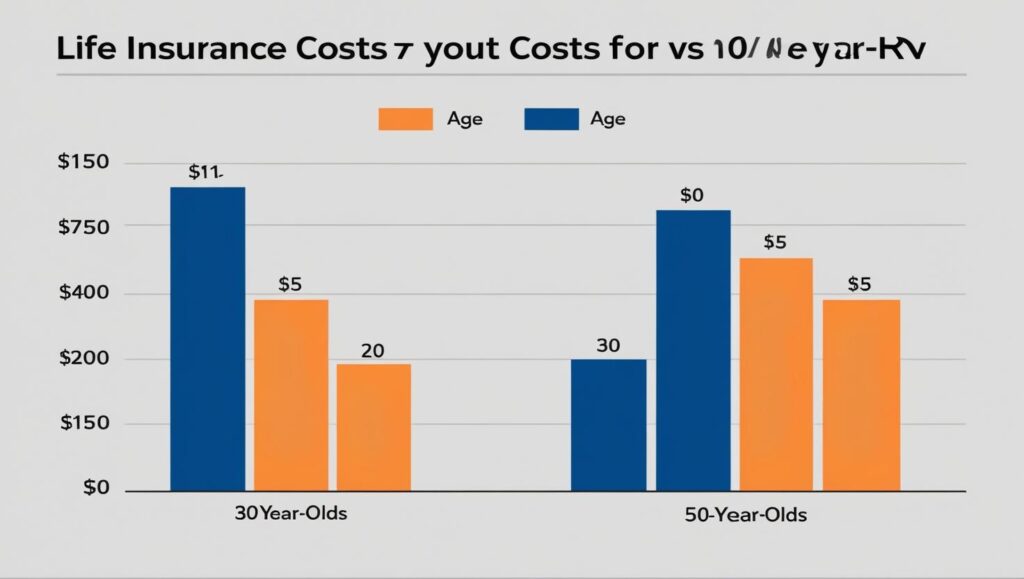

Here is the kicker: The difference between getting a policy at 30 vs. 40 can be hundreds of dollars a year. And if you wait until your 50s or 60s? Well, let us just say it is not going to be pretty.

But Why Does It Work Like This?

Good question. It all comes down to risk. Insurance companies love predictability, and age is one of the biggest predictors of health issues. The older you are, the more likely you are to develop conditions like high blood pressure, diabetes, or heart disease—all things that make insurers nervous.

I once talked to a friend who waited until his mid-50s to get coverage. By then, he had a minor health scare (nothing serious, but enough to show up on medical records). His premiums ended up being double what they would have been if he had locked in a policy a decade earlier.

Moral of the story? Time is not on your side with this one.

So… What Can You Do About It?

First, do not panic. Yes, age matters, but it is not the only factor. Health, lifestyle, and even the type of policy you choose play a role. Still, if you are on the fence about getting coverage, here is my totally unscientific but experience-backed advice:

Do not wait for “the perfect time.” There is no such thing. The best time to get life insurance was yesterday. The second-best time? Today.

Consider locking in a term policy while you are younger. Rates are usually lowest when you are healthy and (relatively) young.

If you are older, shop around. Some companies are more forgiving than others when it comes to age and health.

Final Thoughts

At the end of the day, life insurance is one of those things we all know we should think about… but often put off until it feels urgent. And hey, I get it—talking about mortality is not exactly fun dinner conversation. But here is the thing: The longer you wait, the more expensive it gets.

So, if you have been dragging your feet (like I did), maybe take this as your sign to at least get a few quotes. Future-you will probably thank present-you. And if not? Well, at least you will have one less thing to worry about.

References

Investopedia. (2023). How age affects life insurance rates. https://www.investopedia.com/articles/personal-finance/022615/how-age-affects-life-insurance-rates.asp

U.S. Office of Personnel Management. (n.d.). Federal Employees’ Group Life Insurance (FEGLI) program information. https://www.opm.gov/healthcare-insurance/life-insurance/program-information/

U.S. Bureau of Labor Statistics. (1985). Age-related reductions in workers’ life insurance. Monthly Labor Review, 108(9). https://www.bls.gov/opub/mlr/1985/09/art4full.pdf

SmartAsset. (2023). Age limits and impact on life insurance https://smartasset.com/life-insurance/age-limits-and-impact-on-life-insurance